Introduction

In the dynamic realm of financial management, individuals often encounter complex decisions, such as whether to pursue refinancing or opt for a loan modification. These financial strategies can significantly impact one’s fiscal health, necessitating a deeper understanding of the intricacies involved. In this extensive guide, we aim to unravel the nuances of refinancing and loan modification, shedding light on common challenges and providing invaluable insights to empower you in making well-informed financial choices.

The Refinancing Conundrum

Understanding Refinancing

Refinancing is a strategic financial maneuver that involves replacing an existing loan with a new one, often featuring improved terms, lower interest rates, or adjusted repayment schedules. While the prospect of reducing monthly payments may be enticing, navigating the landscape of refinancing requires a keen understanding of the associated complexities.

Interest Rates and the Refinancing Mirage

At the heart of the refinancing decision lies the promise of lower interest rates. However, the devil is in the details. Borrowers must meticulously analyze associated costs, including closing fees and application charges, to ascertain the actual benefits and avoid falling prey to a financial mirage.

Equity Considerations

Another crucial factor in the refinancing equation is home equity. Lenders often assess the loan-to-value ratio, which may be influenced by fluctuations in property values. Understanding the impact of these variables is essential for making an informed decision.

Common Pitfalls in Refinancing

Credit Score Quandary

Contrary to widespread belief, not everyone qualifies for the enticing interest rates advertised by lenders. Your credit score plays a pivotal role, and a less-than-stellar score may hinder your quest for better terms. It’s imperative to address credit score challenges proactively.

Appraisal Anguish

Property appraisals can introduce an additional layer of complexity. The perceived value of your property may not align with expectations, potentially affecting the loan-to-value ratio and thwarting your refinancing efforts. Being prepared for potential appraisal challenges is key to a smoother process.

The Maze of Loan Modification

Decoding Loan Modification

In contrast to refinancing, loan modification involves adjusting the terms of an existing loan without fully replacing it. This may include extending the loan term, adjusting interest rates, or even principal reduction. While it may sound like a panacea for financial distress, there are intricacies that demand careful consideration.

Qualifying for Loan Modification

Lenders typically require evidence of financial hardship to approve a loan modification. This may involve providing detailed financial records, proof of income changes, or other supporting documents. Meeting these criteria is often a meticulous process that necessitates thorough documentation.

The Negotiation Dance

Negotiating the terms of a loan modification can be akin to a delicate dance with lenders. It requires effective communication, a thorough understanding of your financial situation, and the ability to present a compelling case for modification. Developing strong negotiation skills is paramount in this phase.

Navigating Challenges and Making Informed Choices

The Crossroads Dilemma

As borrowers stand at the crossroads of refinancing and loan modification, the decision-making process becomes crucial. Here are some key considerations to guide you through the labyrinth of choices:

Financial Assessment

Conducting a comprehensive assessment of your financial health is the cornerstone of informed decision-making. Evaluate your income, expenses, and long-term financial goals. This serves as the foundation for determining whether refinancing or loan modification aligns with your objectives.

Professional Guidance

In the intricate world of finance, seeking professional advice can be a game-changer. Consult with financial advisors or mortgage experts who can provide personalized insights based on your unique circumstances. Their expertise can offer a holistic view, guiding you towards the most suitable path.

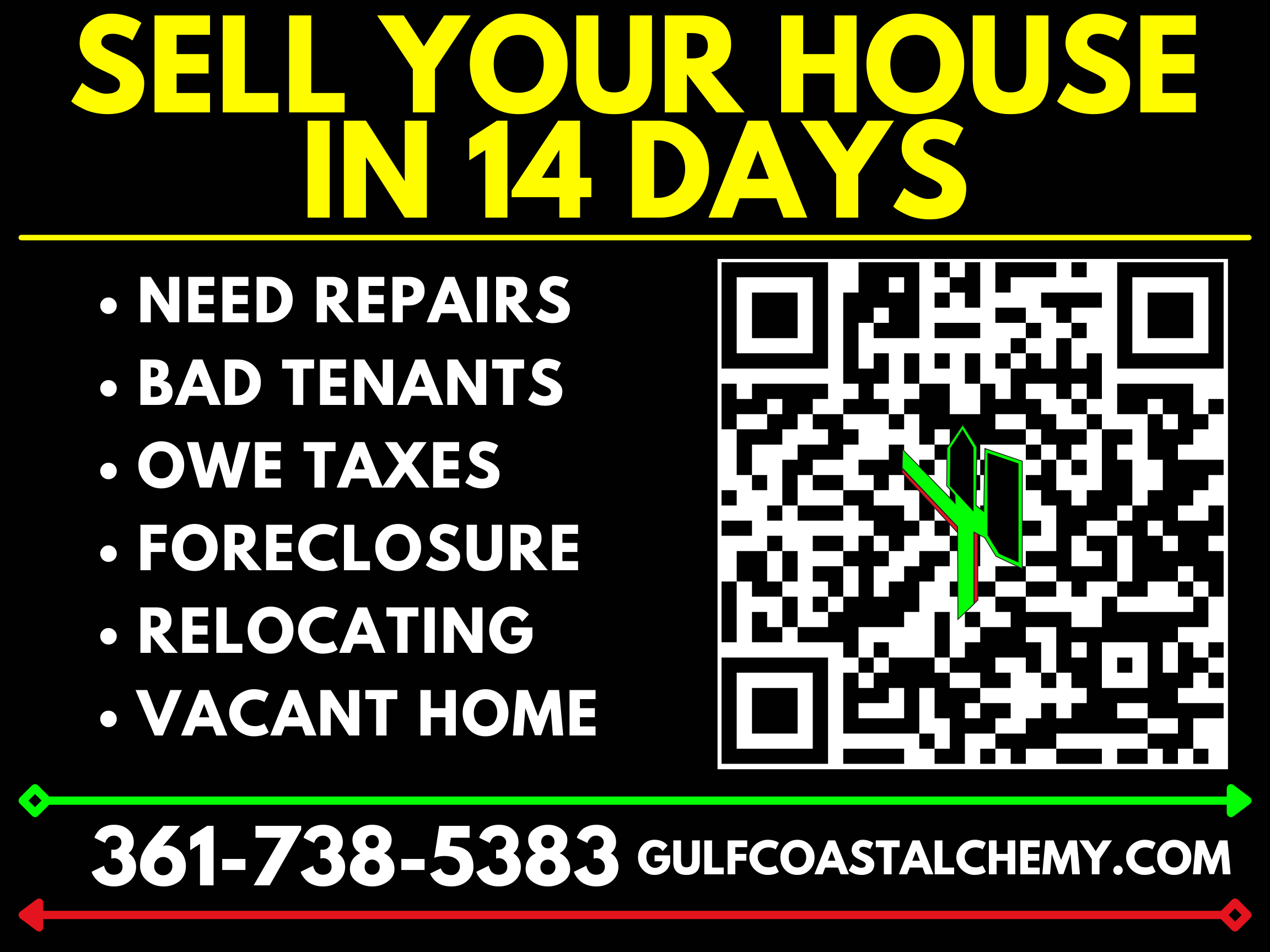

Discover the Benefits of Choosing Gulf Coast Alchemy for Your Home Sale:

✨ Zero Fees: You pay absolutely no fees.

✨ Swift Closings: Choose your closing date.

✨ Guaranteed Offer: Say goodbye to waiting with our guaranteed offer.

✨ Sell As Is: No repairs required – sell your property in its current condition.

Conclusion

In conclusion, the decision to pursue refinancing or loan modification is a multifaceted undertaking that requires careful consideration of various factors. By understanding the nuances of each process and navigating potential challenges, you empower yourself to make informed decisions that align with your financial goals and aspirations.