Finding and evaluating possible investment properties can be a difficult endeavor, especially for individuals who are new to real estate investing. It is critical to conduct due diligence and thoroughly analyze all elements to guarantee that you make a profitable transaction. In this blog post, we’ll discuss tactics for locating and analyzing possible investment properties. We’ll go over things like deciding on your investment goals and criteria, investigating suitable markets and communities, and analyzing homes before making a final decision. Following these pointers will equip you to identify the correct property and make a sound investment.

Establishing Investing Objectives and Criteria

The first step in locating and analyzing possible investment properties is to establish your investing objectives and criteria. This will allow you to refine your search and focus on homes that meet your criteria. Some common investing objectives include earning income through rents, seeking appreciation through property value growth, and capitalizing on tax breaks. It is critical to consider criteria such as location, property type, and budget while appraising homes. Investigating local real estate markets and trends can also aid in the identification of potential investment opportunities. Setting defined goals and criteria, as well as conducting thorough research, can empower you to identify the ideal property and make a confident investment.

Investigating Suitable Markets and Communities

After you’ve established your investing objectives and requirements, the following step is to investigate suitable markets and communities. This will assist you in identifying places with a high potential for return on investment and locating properties that suit your investment goals. Real estate listing websites and market reports are two examples of online resources that might be useful in this process. Local professionals, such as real estate brokers or property managers, can also provide insight into the local market. Visiting possible markets in person can also be beneficial because it allows you to examine features such as walkability, amenities, and potential risks. You can make an informed decision about where to invest and identify properties that are well-suited to your investment goals by completing thorough market research.

Compiling a List of Potential Properties

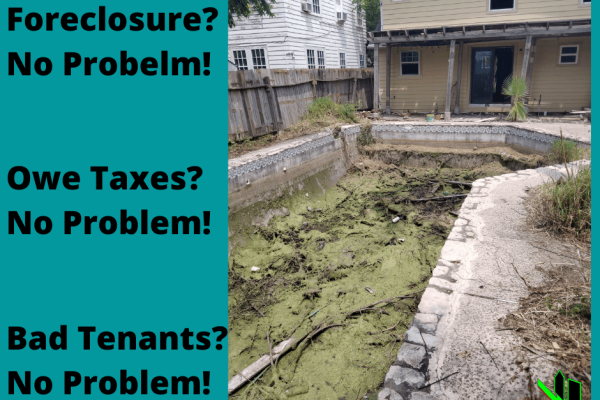

Once you’ve gained a thorough grasp of local markets and found properties that suit your investment objectives and criteria, it’s time to compile a list of potential properties. This could entail looking through web listings, contacting real estate agents or property owners, or networking with other investors to identify off-market prospects. When making your shortlist, keep in mind things like pricing, condition, and potential return on investment. If feasible, visit the properties in person to get a sense of their condition and any potential issues that may need to be rectified. You can proceed to the following step of the process after you have a shortlist of suitable properties in hand: analyzing the properties to make a final decision.

Identifying Potential Risks and Rewards

Evaluating possible investment properties is an important stage in the process of locating the perfect property. Analyzing multiple factors to identify the potential risks and rewards of each property on your shortlist is required. Some important factors to consider when appraising properties are:

- The state of the property: Is the property in need of repairs or renovations? If this is the case, what will be required and how much will it cost?

- The location of the property: Is the property in a desirable neighborhood that will attract tenants or buyers? Is the site related with any potential concerns or risks?

- The property’s potential for return on investment: What is the property’s prospective rental income or sale price? Is it conceivable that the property’s value will rise over time?

You may make an informed judgment about which properties are the best fit for your investment goals by carefully evaluating these and other variables.

Finally, researching and analyzing possible investment properties takes serious analysis and a thorough methodology. You may make confident and lucrative real estate investments by creating clear investing goals and criteria, researching local markets, and evaluating properties based on key characteristics such as condition, location, and potential for return on investment. Remember to do your homework and properly assess each property before making a decision. You may identify the ideal investment property that suits your needs and positions you for success if you use the right tactics and approach.