Real estate investing can appear to be a daunting task. It’s not as simple as investing in a stock or bond and watching it grow. Real estate transactions, on the other hand, are more like a roller coaster ride, with twists and turns and sometimes a loop-de-loop of paperwork. Not to mention the high costs associated with buying and selling a home.

But don’t let that deter you! There is a way to get your feet wet in the real estate market without committing to a full-fledged purchase or down payment. Here comes wholesale real estate. It is a legal strategy that allows you to generate quick and consistent income without the hassle of traditional real estate transactions.

Consider it a shortcut to real estate success. You won’t have to deal with tenants, closings, or even renovations. You only need to find the right property and the right investor to make a profit without ever having to buy the property yourself.

Why not give it a shot? It’s a fun and exciting way to make money by investing in real estate. Continue reading to learn more about wholesale real estate and how to make it work for you.

Important Considerations

- Finding a good deal and passing it on to an investor for a profit is the key to success in wholesale real estate.

- Finding undervalued properties and connecting them with eager buyers is the key to success.

- focus on distressed properties and act as the middleman to bring buyers and sellers together

- Unlike flipping, wholesalers don’t need to do any renovations or carry costs, making it a low-risk investment strategy.

- You can make quick and consistent profits with wholesale real estate if you understand the market and build a strong network of investors.

Quick Rundown on "What is Wholesaling?"

Wholesale real estate is like a closed society that only the insiders know about. It allows investors to make quick money without breaking the bank. Consider it a game of real estate musical chairs: the wholesaler gets a seat (a.k.a. a property) first and then sells it to an interested investor at a higher price. The price difference is like a secret handshake, something extra for the wholesaler.

But it’s not all rainbows and sunshine. Wholesalers are frequently on the lookout for distressed properties, those that owners want to get rid of quickly and don’t want to spend time or money on. It’s similar to discovering a diamond in the rough, but instead of gleaming stones, it’s a fixer-upper house.

But don’t worry, you don’t need a trust fund to play this game. Wholesale real estate is ideal for those who want to invest in real estate but do not have the capital to do so. And you don’t need a real estate license to participate (but always check your local laws to be sure). Wholesale real estate may be the perfect venture for you if you’re a people person with a bit of grit.

The Most Important Thing to remember is a wholesaler acts as a middleman, entering into a purchase agreement with a seller and then finding a buyer willing to pay a higher price for the rights to that same property, without ever owning the property themselves.

Step-by-Step Wholesale Real Estate Instructions

Wholesaling real estate may sound like a fancy financial term, but it really just means “making a quick buck without actually buying a house.” Let’s face it: who doesn’t want to make a quick buck?

Here’s how to go about making it happen:

#1 Do Your Homework

Before you start scouring the MLS for deals, make sure you understand your state’s wholesale laws. And don’t stop with the laws; get to know the areas where you want to invest like the back of your hand.

#2 Keep Your Eyes Open

Look for properties that are listed below market value and have motivated owners. Foreclosed or liens homes are excellent places to begin. These treasures can be found on the MLS, online real estate auction sites, social media, and foreclosure sites.

#3 Compile the Data

Once you’ve found a potential property, double-check the numbers. Determine the fair market value, any required repairs, and the value after repairs. This will assist you in calculating the highest allowable offer and ensuring a profitable transaction.

#4 Create Your Pitch

Make contact with the seller and explain how wholesaling can benefit both of you. Be forthright about the process, and ensure that your contract includes the right to reassign it to another party.

#5 Write Up The Contract

Present your offer to the seller and secure the property. Make sure your contract allows you to assign the contract to another party. Include a contingency in your contract that allows you, as the wholesaler, to withdraw from the deal if you are unable to find a buyer before the contract expires. This reduces your risk.

#6 Locate a Cash Buyer

Now that you have a contract, it’s time to find an investor. Connect with potential buyers by using your networking skills, and don’t be afraid to ask local realtors for leads.

#7 Complete the Transaction

When you’ve found the ideal investor, it’s time to close the deal. Make certain that both parties agree on the terms and conditions, and don’t forget to collect your fee for all of your efforts in bringing the transaction together.

Wholesaling real estate may not be for everyone, but for those with the tenacity and know-how, it can be a quick and easy way to make a lot of money. So go ahead and flip those houses (without actually flipping them).

The Good and the Bad of Wholesaling Real Estate

Good

• Wholesale real estate can teach you all about the market and sharpen your negotiating skills.

• It’s a low-stakes game that requires little upfront investment.

• The cash flow is quick, with a portion of the fee paid at contract assignment and the remainder at closing. There is no requirement to have a good credit score or renovation skills.

• If you have a solid group of investors, you can sell that house quickly.

• If you play your cards right, you can make a large profit in a short period of time.

Bad

• In order to earn a consistent income, you must master the art of networking and have a steady flow of leads.

• You will not make any money until you find properties and investors, so be prepared to work hard.

• Depending on where you live, you may be required to have a real estate license to wholesale.

• The profit margin is typically lower than that of other types of real estate investments.

• Because it is dependent on the availability of suitable properties, wholesale real estate can be unpredictable.

• Wholesalers who are unable to find investors risk losing their earnest money deposits.

• Homeowners may not fully comprehend or feel at ease with the wholesale strategy.

Understanding the Wholesale Real Estate Market

Wholesale real estate is a game of strategy and hustle. It can be a great way to make a quick buck if you’re up for the challenge. However, it is not for the faint of heart.

First and foremost, you must establish a network of investors willing to take a risk on your deals. Without them, you’re out of luck. And, let’s be honest, finding the ideal property is like looking for a needle in a haystack. It’s a beautiful thing to find that diamond in the rough.

Homeowners looking to sell their foreclosed properties are your golden ticket. These are the types of properties that will entice investors like bees to honey. Before making an offer, do your research and determine what repairs or renovations the property will require.

Certain characteristics are required to be a successful wholesaler. You must be goal-oriented, organized, and capable of effectively delegating tasks. Don’t be afraid to collaborate with those who can provide leads, such as the Multiple Listing Service. To streamline your workflow, embrace technology and use customer relationship management software and mobile apps. A well-designed website can also be an effective tool for marketing your services and attracting potential buyers and sellers. Most importantly, strive to learn and grow from each experience, and ensure that all parties involved in the transaction are satisfied.

From Theory To Practice

Real estate wholesaling may sound complicated, but it is actually quite straightforward. Consider it matchmaking, but instead of matching people, we’re matching properties with investors.

Consider a homeowner who believes they will never get a fair price for their distressed property. They are stuck with a property that they cannot sell and cannot afford to repair. That’s where the wholesaler comes in, like a knight in shining armor rescuing damsels in distress instead it is a distressed property.

The wholesaler makes an offer to the homeowner, and they agree to put the house under contract for $1000,000. Using their extensive network of investors, the wholesaler locates a willing buyer for $110,000. The contract is assigned to this investor, who now has a profitable fixer-upper project, while the wholesaler walks away with a $10,000 profit without ever having to buy the home.

In a nutshell, the wholesaler served as a go-between, connecting the homeowner with a potential buyer. The buyer paid a $10,000 fee to the wholesaler and completed the transaction with a $100,000 payment.

It’s as simple as that! There’s no need to break a sweat or spend a fortune. Wholesale real estate is a straightforward and low-risk way to profit in the real estate market.

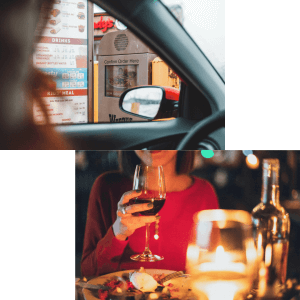

Wholesale vs Flipping: Fast Food vs Fine Dining

Comparing wholesale real estate to flipping is like comparing apples and oranges, or, more precisely, a quick and easy fruit salad to a fancy fruit platter. Both have advantages, but they are fundamentally different.

With wholesaling, you act as a real estate middleman, bringing together motivated sellers and cash-hungry investors. You’re only keeping the property long enough to find someone else to take it off your hands. It’s a quick and simple transaction, similar to a drive-through breakfast burrito.

Flipping, on the other hand, is more akin to a fine dining experience. You are purchasing the property, repairing it, and then reselling it for a profit. Like a fancy dinner party, it takes more time and requires more investment. You’ll have to pay for the property, renovations, and ongoing expenses such as a mortgage, property taxes, and insurance.

In a nutshell, wholesaling is the fast food of real estate, whereas flipping is the sit-down meal. Both can be delicious, but they necessitate a different level of dedication and investment.

If you want to work in wholesale real estate, prepare to roll up your sleeves and do some digging.

You’ll need to be an expert at spotting properties priced below market value and convincing both homeowners and investors to jump on board with your deals. Building a strong buyer network is essential, so be prepared to put in the effort to make those connections. Don’t forget to have some cash on hand for those pesky earnest money deposits. But, hey, all that effort is worthwhile when you’re reaping the benefits of your quick and easy wholesale deals.

Do You Need a License to Wholesale Real Estate?

It’s like attempting to navigate a minefield, only with fewer explosions and more paperwork. To legally wholesale properties, you may need a real estate license depending on where you live. But don’t worry, it’s not like getting a driver’s license, where you have to take a test; instead, it’s more like a scavenger hunt in which you have to find the correct laws and regulations. To avoid legal snafus, consult with a real estate attorney to ensure you’re following all of the rules and regulations. No one wants to end up on the wrong side of the law, unless you like that kind of thing.

What exactly is a Wholesale Contract?

A wholesale real estate contract is similar to a handshake between a wholesaler and a homeowner, signaling the beginning of a wild and exciting journey to find an investor to buy the house. It’s like a treasure map, pointing the way to potential profits, but without the X. Once the wholesaler has located the investor, they pass the baton (or, rather, the contract) with a fancy legal document known as the Assignment of Real Estate Purchase and Sale Agreement. It’s similar to handing over the keys to a secret club, but instead of a club, it’s a house, and the keys are a legally binding agreement. So grab your compass and start your treasure hunt!

Wholesale Real Estate Is the Dream of the Middleman

Real estate wholesalers are the real estate world’s superhero sidekicks, swooping in to save the day for distressed homeowners and investors looking for a below-market deal.

Consider wholesale real estate to be a stepping stone to a real estate empire. It’s a low-risk way to get your feet wet in the market, requiring little to no capital. With time and practice, you’ll be able to juggle multiple deals and make a killing.

Sure, there’s some risk involved, especially with those pesky earnest money deposits. However, if you’re willing to put in the time and effort, the benefits of running a successful wholesale real estate business are well worth it.